PUBLIC BENEFITS

Accessible and inclusive public benefit programs are essential to strengthening communities and the country. We’re building the case for whole-family, community-centered approaches to food assistance, cash support, and social services.

Publication Types

Topics

Authors

Millions of people rely on public benefits programs to meet their basic needs, but outdated systems can make it difficult for families to access support. As states work to modernize public services, people-centered design offers a promising approach. Understanding how states translate principles into practice is essential for policymakers and administrators to create more effective public benefits systems.

This case study, part of the Georgetown Center on Poverty and Inequality’s People-Centered Digital Benefits Project, highlights how the state of New York’s Office of Customer Experience is transforming service delivery by embedding customer-centered design across state agencies. This brief explores the leadership structures, community partnerships, and human-centered design practices that helped New York redesign Medicaid renewals, modernize WIC outreach, and streamline child care assistance – offering lessons and practical strategies for other states.

January is National Poverty in America Awareness month, offering an opportunity to reflect on the policy choices the United States government does or does not make to ensure that economic opportunity is a right, hardship and instability are the exception, and children have what they need to reach their full potential. In this blog post, GCPI highlights important but perhaps less well-known facts about who experiences poverty in the United States, and which proven policy solutions, such as the Child Tax Credit, could dramatically reduce poverty.

Millions of Americans rely on public benefits to meet daily needs, yet unnecessary barriers and outdated technology too often make accessing help a struggle. GCPI’s People-Centered Digital Benefits Project highlights state innovations for modernizing benefits delivery systems to meet people’s needs.

In this case study, Visiting Fellow Andrés Argüello explores Maryland’s people-centered design approach to building the One Benefits application—which allows people to apply for multiple public benefits programs through a single, streamlined application—and the leadership, governance, and organizational structures that were critical to success.

Millions of Americans rely on public benefits to meet daily needs, yet unnecessary barriers and outdated technology too often make accessing help a struggle. GCPI’s People-Centered Digital Benefits Project highlights state innovations for modernizing benefits delivery systems to meet people’s needs.

Massachusetts offers a particularly powerful example of people-centered public benefits modernization. In this case study, Visiting Fellow Andrés Argüello profiles the creative, multi-pronged effort of the Massachusetts Digital Service to build public-sector capacity across state government. Massachusetts is helping state agencies improve their digital services and ensuring that the people designing and overseeing delivery of digital benefits are the same people who hear from residents, spot system failures, and are held accountable for fixing them.

The Child Tax Credit is designed to help families afford the increasingly high costs of raising children. This analysis explores how different types of families fare under the rules today, examining issues relating to eligibility, refundability, and child claiming rules that can keep families from getting the support they need. The stories in this post show the need for changes to the tax code to better reflect the realities of families today.

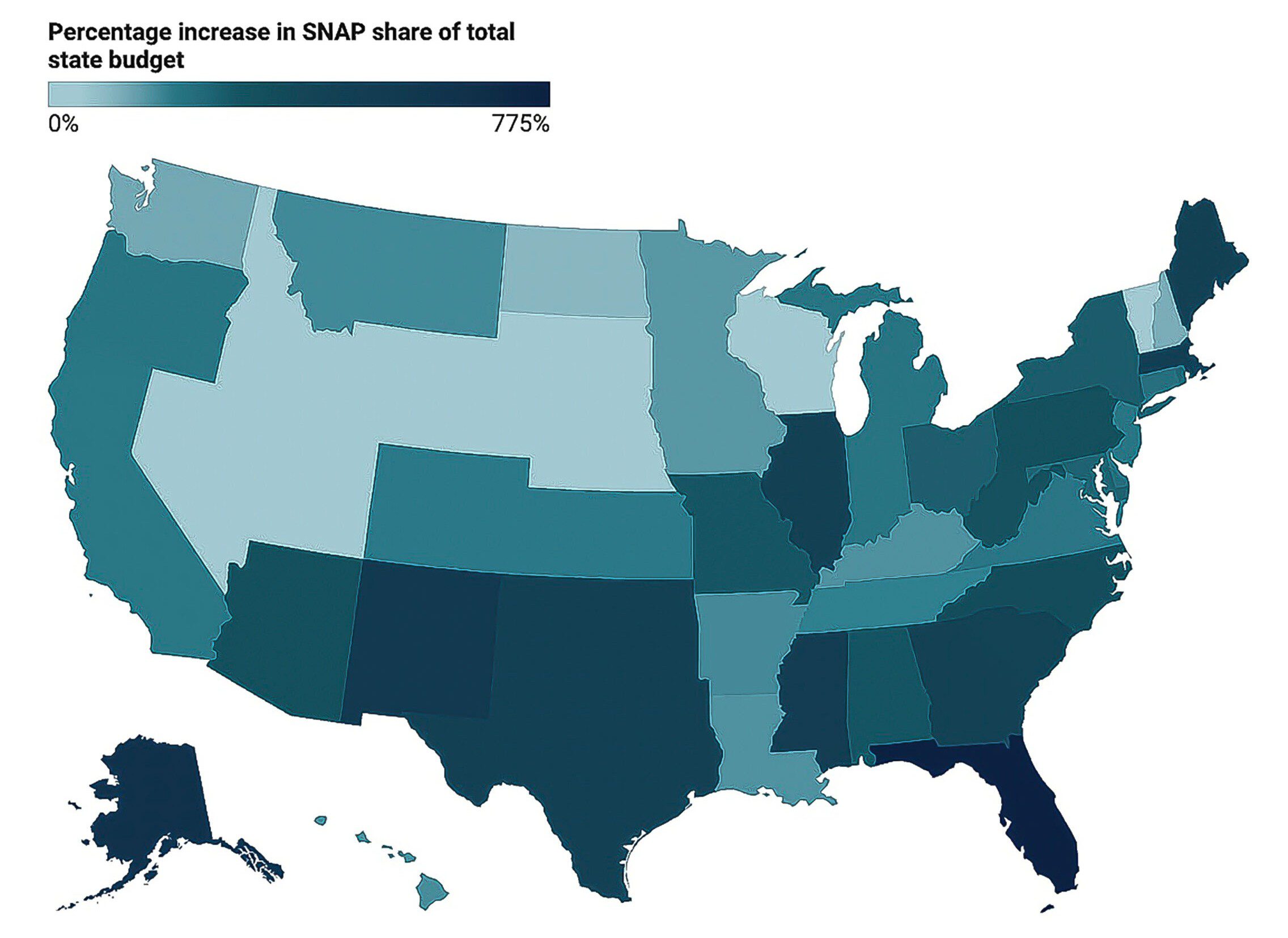

SNAP is a lifeline for more than 42 million people, providing food that stabilizes families and strengthens communities, but the One Big Beautiful Bill Act (OBBBA) of 2025 made seismic changes to the structure of SNAP, shifting costs to states. This analysis maps the impact of OBBBA changes to SNAP on all 50 state budgets, highlighting how much each state’s SNAP costs are expected to rise in the years ahead—both in dollars and as a share of state budgets.

Millions of Americans rely on public benefits to meet daily needs, yet outdated delivery systems and unnecessary barriers too often make accessing help a struggle. GCPI’s new People-Centered Digital Benefits Project highlights state innovations and the lessons they offer for creating modern benefit delivery systems that meet people’s needs. In this post, Visiting Fellow Andres Arguello previews the project, which will showcase proven models that are fast, fair, and dignified. We will make the successes visible and replicable, providing practical resources for policymakers, agency leaders, and practitioners.

As states move toward digital benefit systems, new opportunities arise, but so do new risks. In this post, Affiliate Scholar Jae June Lee examines the roots of the class differential in privacy, and raises broader concerns about the increasing surveillance that low-income families face—from invasive verification practices to expansive data-sharing systems. He explores why safeguards are critical to preventing a “digital welfare dystopia” and offers insights for practitioners to design and implement digital systems carefully.

Without action from Congress, subsidies that keep health insurance premiums affordable for millions will expire at the end of 2025. Expiration of the enhanced premium tax credits would push health care out of reach for millions, roll back progress toward health equity, and destabilize the health care system. Families with low incomes, particularly Black and Latinx families, and people at risk of losing Medicaid would be hit the hardest. This analysis highlights what’s at risk for families, health equity, and the broader health care system.

Women are working despite the odds, including unequal pay, unpredictable low-wage jobs, and few or no benefits. The recently passed reconciliation law—dubbed the “One Big Beautiful Bill Act” (OBBA) by its backers—adds harsh new work requirements to SNAP and Medicaid. The result? Millions of working women, mothers, single moms, and grandmothers could lose access to food assistance and health coverage—not because they don’t work hard enough, but because of rigid rules that ignore the realities of women’s lives.