An America without poverty is possible.

The Georgetown Center on Poverty and Inequality is a research center that generates policy solutions to improve the lives of people experiencing poverty in the United States.

Our Policy Issues

Good Jobs

Promoting job quality and job creation policies that ensure well-paying, secure jobs with fair benefits and build worker power.

Explore Good Jobs ≫

Public Benefits

Building the case for whole-family, community-centered approaches to food assistance, cash support, and social services.

Explore Public Benefits ≫

Income & Cash

Championing income supports—including cash assistance and tax credits—that help families meet their basic needs and promote economic mobility.

Explore Income & Cash ≫

Care

Designing policies that recognize and fairly compensate caregiving labor, including paid leave.

Explore Care ≫

Housing

Investing in housing as a social good, including solutions that secure stable, affordable housing for all families.

Explore Housing ≫

Latest from GCPI

Millions of Americans rely on public benefits to meet daily needs, yet unnecessary barriers and outdated technology too often make accessing help a struggle. GCPI’s People-Centered Digital Benefits Project highlights state innovations for modernizing benefits delivery systems to meet people’s needs.

Massachusetts offers a particularly powerful example of people-centered public benefits modernization. In this case study, Visiting Fellow Andrés Argüello profiles the creative, multi-pronged effort of the Massachusetts Digital Service to build public-sector capacity across state government. Massachusetts is helping state agencies improve their digital services and ensuring that the people designing and overseeing delivery of digital benefits are the same people who hear from residents, spot system failures, and are held accountable for fixing them.

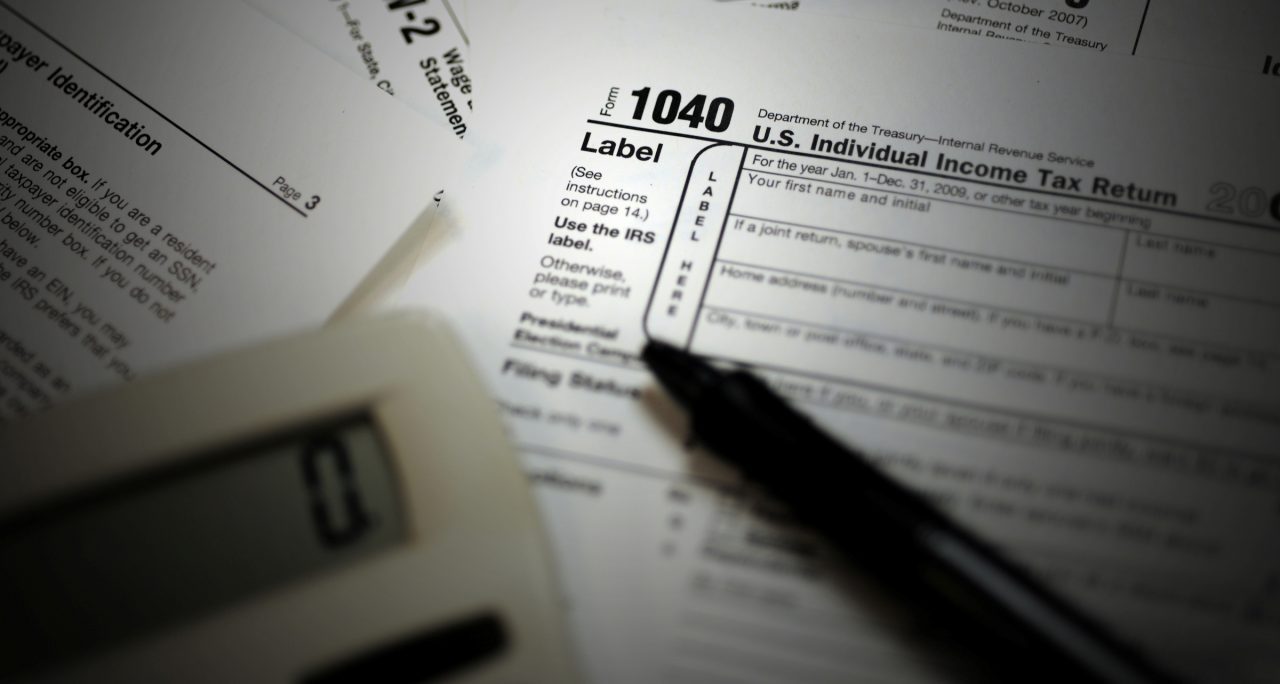

The Child Tax Credit is designed to help families afford the increasingly high costs of raising children. This analysis explores how different types of families fare under the rules today, examining issues relating to eligibility, refundability, and child claiming rules that can keep families from getting the support they need. The stories in this post show the need for changes to the tax code to better reflect the realities of families today.

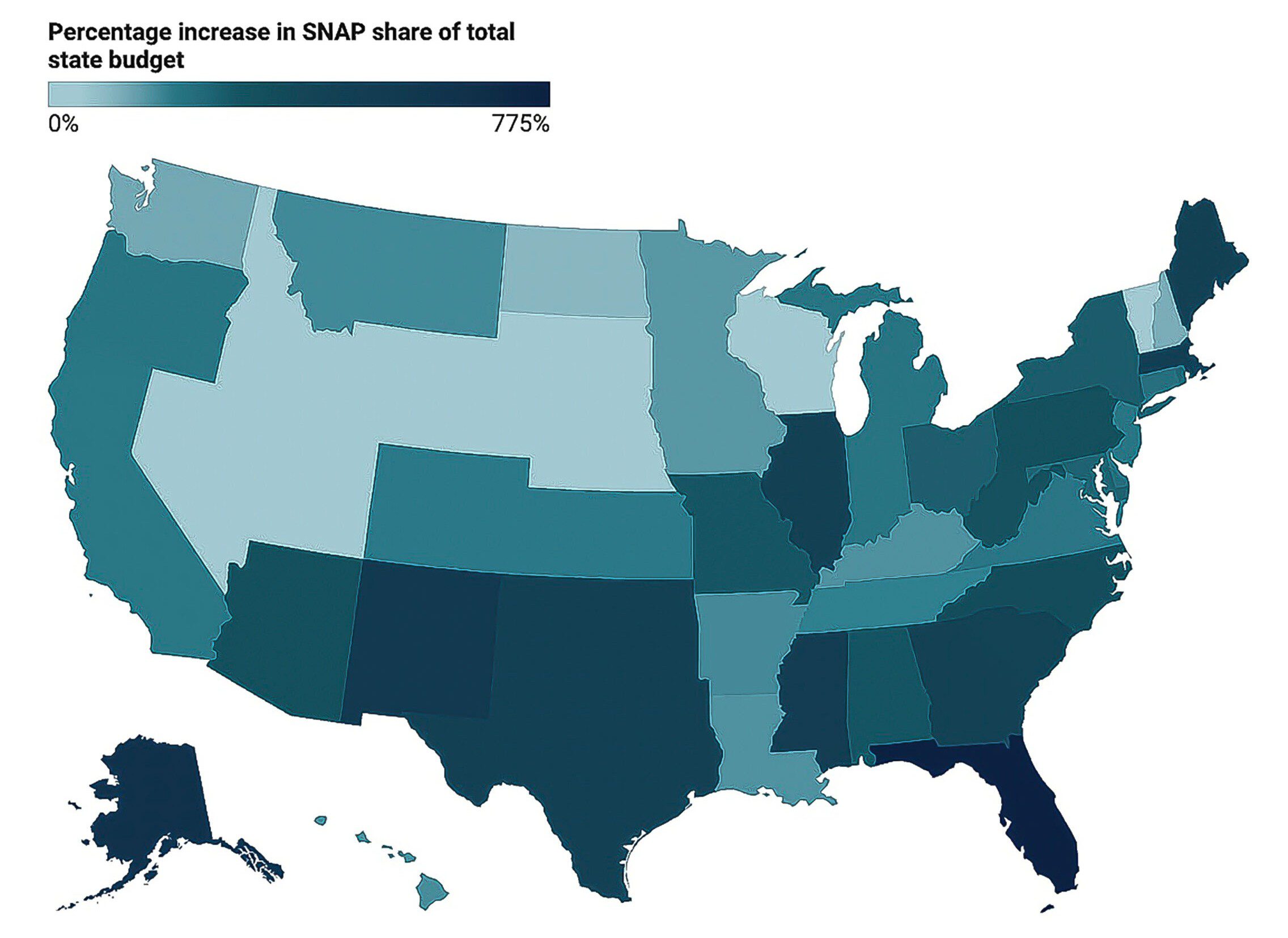

SNAP is a lifeline for more than 42 million people, providing food that stabilizes families and strengthens communities, but the One Big Beautiful Bill Act (OBBBA) of 2025 made seismic changes to the structure of SNAP, shifting costs to states. This analysis maps the impact of OBBBA changes to SNAP on all 50 state budgets, highlighting how much each state’s SNAP costs are expected to rise in the years ahead—both in dollars and as a share of state budgets.

Millions of Americans rely on public benefits to meet daily needs, yet outdated delivery systems and unnecessary barriers too often make accessing help a struggle. GCPI’s new People-Centered Digital Benefits Project highlights state innovations and the lessons they offer for creating modern benefit delivery systems that meet people’s needs. In this post, Visiting Fellow Andres Arguello previews the project, which will showcase proven models that are fast, fair, and dignified. We will make the successes visible and replicable, providing practical resources for policymakers, agency leaders, and practitioners.

As states move toward digital benefit systems, new opportunities arise, but so do new risks. In this post, Affiliate Scholar Jae June Lee examines the roots of the class differential in privacy, and raises broader concerns about the increasing surveillance that low-income families face—from invasive verification practices to expansive data-sharing systems. He explores why safeguards are critical to preventing a “digital welfare dystopia” and offers insights for practitioners to design and implement digital systems carefully.